Process SBA loans up to 6x faster with FileInvite

Join dozens of CDCs and SBA lenders who trust FileInvite's leading document collection software to:

- Standardize their digital onboarding experience

- Improve the borrower and lender experience

- Dramatically decrease loan document turnaround times

![]()

![]()

Shorten the timeline from Collections to Closing

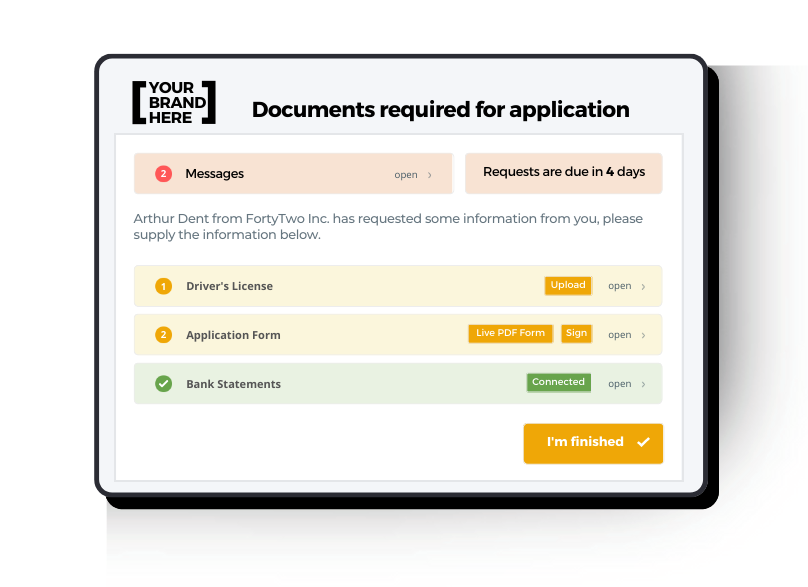

You and your team can use turnkey templates to send out checklists of documents required, depending on which program the potential borrower qualifies for.

When it comes to request and collecting information, you can:

- Easily collect KYC requirements

- Quickly and easily review and approve documents from within your admin portal

- Monitor progress of applications to prioritize your most engaged borrowers

- Share applications and documents with internal teams as needed

.png?width=850&height=600&name=Centralized%20Messaging%20(1).png)

Consolidate all questions & answers into one central & secure portal

Collecting sensitive data on your behalf is what we do; both you and your borrowers should feel comfortable knowing FileInvite goes above and beyond best practices:

When it comes to centralizing your client communications, you can:

- See all questions and comments from within your secure admin portal

- Respond to any questions and comments from within your admin portal

- Notify your clients that you've responded via an SMS notification (but for security's sake, they will have to enter their portal to respond)

Leverage our integrations and/or API to streamline your workflow

Some of our best clients use FileInvite in place of some tools (BMI) and in addition to others (Ventures). Regardless of which other tools are key players in your workflow, FileInvite will complement them.

That's because FileInvite:

- Natively integrates with Google Drive, OneDrive, Dropbox and Zapier

- Offers an enterprise-grade API that allows you to combine the power of FileInvite's solution with your exisiting workflow and/or interface

Prioritize data security with our encrypted document upload portal

Loan applicants can provide required documents directly into their secure portal, getting documents out of unsecured email inboxes.

When it comes to their secure portals:

- You can password protect their portals

- You can deliver a completely branded experience

- Your borrowers can access and add to their secure portal from any device, even signing documents straight from their phones

- Lenders can securely access total financing package

.png?width=300&height=80&name=CapStar%20%20(1).png)