Commercial Real Estate Loans: What You Need to Know

Discover the ins and outs of commercial real estate loans. Learn about different lenders, loan types and how to secure funding for your business.

Safeguard borrower information with ease by learning the ins and outs of SBA Form 1919 for 7(a) loans, ensuring a secure lending process.

In 2023 alone, the Small Business Administration (SBA) approved over 57,000 loans totaling over $27 billion for small businesses.

For small businesses, 7(a) loans can be a lifeline through uncertain economic times, and SBA Form 1919 is the gateway to 7(a) loans.

In this article, we’ll introduce SBA Form 1919 as well as the 7(a) loan program it belongs to, discuss everything small businesses and SBA lenders need to know about filling out and submitting Form 1919, explore the security risks associated with submitting the form, and how FileInvite can help businesses and lenders avoid a major security pitfall.

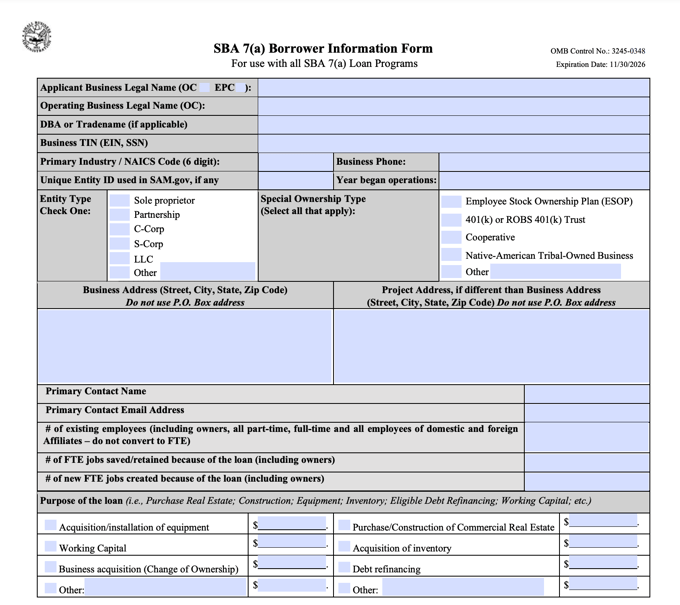

SBA Form 1919, or the Borrower Information Form, is part of a larger application process small businesses go through to obtain 7(a) loans. The seven-page form includes sections for information about the business, ownership interest, uses of funds, and the nature of the business, and was last updated in December 2023.

When eligible small businesses need financial help, SBA 7(a) loans can help them pay for things like:

Qualified small businesses can also use funds from 7(a) as short- or long-term working capital or to fund complete or partial changes of ownership.

SBA 7(a) loans are similar to another financial product offered by the SBA: 504 loans. The key difference between the two loan programs is that 7(a) loans give businesses more options in how they use their funds. SBA 504 funds can only be used to purchase or improve long-term fixed assets, while SBA 7(a) funds can also be used for things like working capital and debt refinancing.

SBA 7(a) loans get their name from section 7(a) of the Small Business Act—the 1958 legislation that created the SBA and the 7(a) loan program. Though 7(a) loans are as old as the SBA itself, Form 1919 is a more recent document that brings together multiple pieces of information into a single convenient form.

The form makes it easier for businesses to apply for 7(a) loans by consolidating sources of information and providing a convenient way for businesses to answer foundational questions about their loan with less paperwork.

The SBA has updated Form 1919 many times over the years, including a major update in 2017 and consistent smaller updates as recently as December 2023.

The biggest change with this newest iteration of Form 1919 is that only one authorized representative is required to fill out the form, while previous versions of the form required every beneficial owner of at least 20% of the company as well as each guarantor to fill out the form separately. The newest version of the form also tweaked several requirements, such as adding lending and lobbying to the list of activities that may have eligibility restrictions.

In 2023, the SBA approved over $27 billion in 7(a) loans. That’s down from the 2021 high of $36.8 billion, but up from pre-pandemic levels. SBA Form 1919 is the gateway for businesses to claim their funding in 2024 and beyond.

To receive a 7(a) loan, small businesses must fill out Form 1919. A copy of the form must be filled out by each principal stakeholder or owner who controls at least 20% of the business, trustors, and anyone hired to run the business’ general operations.

In previous versions of Form 1919, each co-applicant had to prepare and sign their own copy of the form, but the December 2023 update changed this requirement to allow an authorized representative to complete and sign the form on behalf of other co-applicants.

The SBA offers 7(a) loans to qualified small businesses that meet the following eligibility requirements:

Businesses that meet these criteria are still subject to the underwriting criteria of their lender. While the SBA guarantees up to 75% of 7(a) loans, the funds themselves are provided by third-party qualified lenders who may have their own requirements.

The form is relatively short—7 pages total with about 4 pages of disclosures and 3 pages the borrower must fill out. To complete Form 1919, small businesses will need the following information:

While the form is relatively short, it can represent a large volume of paperwork. For example, if businesses answer “yes” to any of the questions in the questionnaire, they must attach supporting documentation explaining their answer in further detail.

The 13 yes/no questions on the form can also clarify your organization’s eligibility. For example, question 2 asks if the applicant or owner is delinquent on federal debt, and question 7 asks if the business earns revenue through “vice activities.”

The beneficial owner should carefully read the entire document to ensure it’s filled out completely and accurately before signing. Their signature certifies that the information in the form is true and correct, that they meet the requirements outlined in the document (e.g. are not past due on child support, are not involved in illegal activities, etc.), and that they consent to the use of IRS information.

Form 1919 is not just a means of collecting data — it’s also a commitment to perform certain obligations like maintaining financial records, posting SBA Form 722, and complying with SBA requirements.

Data is the world’s most valuable resource. Not because it’s an asset-backed security (it’s not), but because information is power. When data analysts have access to quality data, they can extrapolate quality insights that fuel profitable, data-driven business decisions. However, when malicious bad actors have quality data, they can leverage it for their financial gain — and businesses’ loss.

As small businesses fill out and submit SBA Form 1919, they end up collecting and transmitting significant Personally Identifiable Information (PII) from a variety of sources. Individual applicants, loan brokers, and other intermediaries must securely transmit this documentation to the lender and/or CDC but emailed PDFs, faxes, and snail mail all come with major security risks that can damage your privacy and your credibility. In a world where cyber threats are at an all-time high, every insecure transfer becomes a weak spot that can be exploited.

If a malicious third party intercepts that information in transit, they could potentially gain access to PII, which could negatively impact both the business and the owners in several ways:

These risks aren’t inherent to Form 1919 — they arise when documents like Form 1919 are mishandled.

Because of the sensitivity of SBA Form 1919 (as well as all the other paperwork small businesses must submit), qualified lenders use secure channels to submit the final documentation to the SBA. While businesses can mitigate these risks by practicing caution, it’s ultimately the prerogative of the lender to request information via a secure, collaborative portal.

FileInvite is a collaborative document collection solution that allows SBA lenders to securely request and collect Form 1919 (and all other documentation) through a password-protected portal.

Without this technology, borrowers are vulnerable to security breaches. The lender may have a secure way to transmit their information to the SBA, but the small business may not have a way to securely transmit the information to the lender.

But what if you're filling out 7(a) loan documentation -- and thus Form 1919 -- on behalf of the borrower, you might be asking: "How do I best request and collect borrower information and then send that completed application (with PII) on to the lender?" Well, with a collaborative solution like FileInvite - both of these workflows can be easily and securely accomplished. A password-protected document collection solution like FileInvite protects small business borrowers, lenders, as well as any intermediaries that are required to be included within the lending process. Borrowers benefit from the convenience of a centralized document portal, and both the borrower and lender can enjoy the confidence and peace of mind that comes from security, not to mention the increased visibility, consolidated communications, and accelerated loan processing times.

FileInvite enhances security and dramatically streamlines the document-gathering process, making it one of the easiest ways lenders can expedite the approval process. FileInvite’s cloud-based solution allows lenders to automate the document collection process, more easily collaborate and communicate with required parties, as well as password protect their portals, which borrowers can safely access from any device.

Ultimately, SBA lenders use FileInvite to process loans up to 6x faster.

Ready to see the impact FileInvite could make on your organization? Request a demo to see FileInvite in action.

Discover the ins and outs of commercial real estate loans. Learn about different lenders, loan types and how to secure funding for your business.

Discover the process of applying for an SBA 504 loan, with details on eligibility and necessary paperwork. Expect an average application timeline of...

Learn how the SBA 504 loan program can help your small business secure funding for long-term assets like real estate and equipment with the right...

Eliminate the monotony of back-and-forth emails and inefficient systems when gathering client information. Get hours back each week as FileInvite handles the most time-consuming work for you.

Get started in as little as 5 minutes.